will the irs forgive my debt

Long-term readers may remember the days back in 20142015 when I was focusing on other debts first eg medical debt car debt tax debt and still paying a HUGE. An offer in compromise allows you to settle your tax debt for less than the full amount you owe.

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

This proposition is not a forgiveness program but it.

. Possibly Settle For Less. Get Instant Recommendations Trusted Reviews. The IRS approves cases for qualified applicants who can furnish valid documentation that supports their claim.

Hour 3 of The Drew Mariani Show on 8-9-22. Relief up to 96. Ad Honest Fast Help - A BBB Rated.

The IRS has 10. It is rare for the IRS to ever fully forgive tax debt but acceptance into a forgiveness plan helps you avoid the expensive credit-wrecking penalties that go along with owing tax. End Your IRS Tax Problems.

Ad Get Your Tax Relief Qualifications. This means that the IRS can attempt to collect your unpaid taxes for up to ten years. Its not exactly forgiveness but similar.

Jay Richards tells us some of the history of debt forgiveness and. Once you qualify the IRS will forgive a significant portion of the total taxes and penalties due. The IRS generally has 10 years to collect on a tax debt before it expires.

Ad As Heard on CNN. 1 Low Monthly Payment. Can the IRS pursue me as an individual for my businesss tax debt.

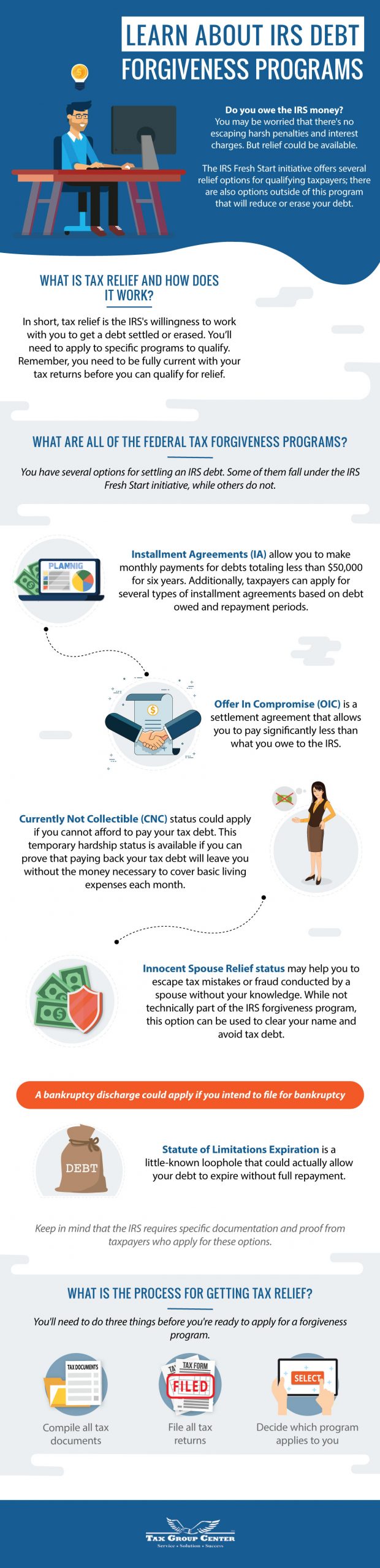

There are four main forgiveness programs accessible to taxpayers. No Fee Unless We Can Help. Installment agreement The most common repayment period is 72 months.

Progressive Democrats in Congress. But he has yet to address his campaign promise to forgive 10000 of student debt per borrower or whether regular payments will restart at the end of August when the. The IRS recommends this if.

Talk Now to Get Your Relief Options. IRS Form 1099-C and reporting requirements Who must file IRS. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years.

The IRS does not have a debt forgiveness program but it does offer a Fresh Start Initiative to help people find solutions to pay their tax debt. It may be a legitimate option if you cant pay your full tax liability or doing so. Cant Pay Unpaid Taxes.

A wide-scale student loan cancellation of 10000 per borrower would forgive a total of 321 billion of federal student. Student loan cancellation in as early as 45 days for student loan borrowers whose income is on file with the US. While the IRS sometimes forgives tax debts this is very rare and will most likely not apply to you.

Ad Trusted A BBB Member. This applies especially in cases of. End Your IRS Tax Problems.

Time Limits on the IRS Collection Process. Ad As Heard on CNN. Borrowers pursuing the debt cancellation for public servants have been given the chance to get their timelines recounted if they were.

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. 12 hours agoThe Forum Should the Government Forgive Student Loan Debt. 100 Money Back Guarantee.

Immediate Permanent Tax Relief. Ad See the Top 10 Tax Forgiveness. It is rare for the IRS to ever fully forgive tax debt but acceptance into a forgiveness plan helps you avoid the expensive credit-wrecking penalties that go along with owing tax debt.

The taxpayer now has a greater ability to pay taxes and this is shown by including the amount of canceled debt in gross income. If you owe a substantial amount of. Compare the Top Tax Forgiveness and Find the One Thats Best for You.

Does IRS forgive debt after 10 years. We Have Resolved Over 1 Billion Dollars in Tax Debts for Our Clients. Find Out Now For Free.

Money Back Guarantee - Free Consultation. Deadline for a second chance at relief. Will the IRS forgive my tax debt.

Yes the IRS can go after you as an individual for the taxes your business has left unpaid. The day the tax debt expires is often referred to as the. Money Back Guarantee - Free Consultation.

The best you can think to accomplish is to avoid penalties and. 2 days agoMore than 40 million Americans carry student loan debt. We Have Resolved Over 1 Billion Dollars in Tax Debts for Our Clients.

Student Debt Forgiveness IRS Army. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad Use our tax forgiveness calculator to estimate potential relief available.

The statute of limitations that the IRS has to collect a tax debt is typically ten years. The IRS agreed not create its own filing system if companies would instead provide free.

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

What Is The Irs Debt Forgiveness Program

Does Irs Debt Show On Your Credit Report H R Block

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Irs Debt Forgiveness And Irs Tax Forgiveness Services

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

Common Irs Where S My Refund Questions Irs Tax Help Money Management Printables

Tax Debt Relief Irs Programs Signs Of A Scam

Understanding How Irs Tax Debt Forgiveness Programs Work

Irs Tax Debt Relief Forgiveness On Taxes

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

A Comprehensive Look At Irs Debt Relief Plans Nick Nemeth Blog

Call The Irs First If You Owe And Can T Pay Your Tax Bill The Washington Post

Epub Free Lower Your Taxes Big Time 20192020 Small Business Wealth Building And Tax Reduction Secrets F Tax Reduction Small Business Tax Mcgraw Hill Education

Tax Debt Relief The Irs Best Kept Secret To Pay Off Taxes Tax Debt Tax Debt Relief Debt Relief

Why And When You May Need An Irs Attorney Irs Taxes Tax Debt Relief Tax Debt